S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

23 Feb, 2023

By Eri Silva

| Aluminum alloys at Rusal's Krasnoyarsk smelter in Russia. The company is the only aluminum producer in Russia, which accounts for 5% of global aluminum output. Source: Laski Diffusion/Hulton Archive via Getty Images |

Russian aluminum giant United Co. Rusal IPJSC is looking ahead to expanding operations and selling its low-carbon product into China after booking an estimated 10.6% increase in net income in 2022, according to S&P Global Market Intelligence data.

|

The past year came with challenges as the company managed a spike in production costs and broken business ties, with more possibly on the way as Russia's war drags on in Ukraine and the end of contracts with major buyers are publicly announced. Rusal has evaded sanctions as various countries have tried to avoid disruptions to local, aluminum-dependent industries. The company is the only aluminum producer in Russia, which accounts for 5% of global aluminum output. Rusal is 56.9% owned by En+ Group IPJSC, and its founder, Oleg Deripaska, has been sanctioned by the U.S. and Australia.

Rusal's largest setbacks since the invasion began include the suspension of its Nikolaev refinery in southern Ukraine and Australia's ban on alumina exports to Russia. However, company executives said they expect sales to remain steady in 2023 as the miner aims to add production in Siberia, strengthen ties with China and increase sales to other Asian nations.

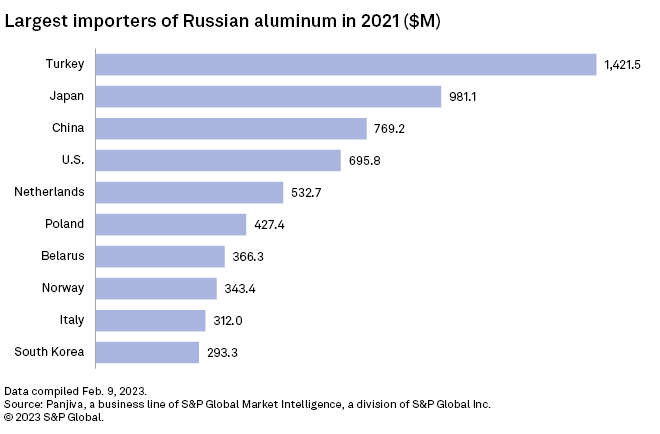

"Rusal has been selling more metal into places like Turkey. One of Rusal's key markets is Asia ex-China; they are selling into places like [South] Korea, Malaysia, Indonesia, Vietnam," Uday Patel, head of base metals markets at Wood Mackenzie, told S&P Global Commodity Insights. "Europe, it's a bit of a cloudy picture because Russian metal is still coming into Europe, except people don't necessarily talk about it."

Profits up, investor confidence down

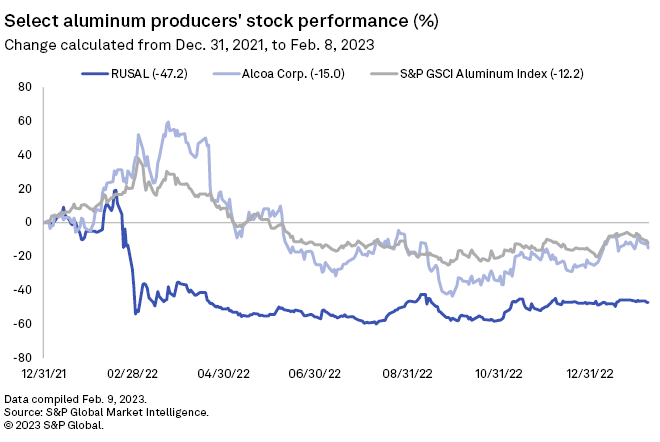

Investors immediately punished the company after the invasion. Rusal's stock price declined by almost 60% to 44 cents per share from Feb. 18, 2022, to March 2, 2022, and has stayed at about 50 cents per share with slight volatility.

During the early days of the war, Rusal suspended alumina shipments from its 1.8-million tonnes per year Nikolaev refinery in Ukraine, forcing the company to divert bauxite cargoes from Guinea. The aluminum giant faced a more serious setback in late March 2022 when Australia banned alumina exports to Russia.

The secondary sanctions squeezed Rusal, which received 19% of its alumina from Queensland Alumina Ltd., a company in which it has a 20% stake.

"These factors, as well as the strengthening of the ruble, led to an increase in production costs," Rusal said in its earnings statement for the first half of 2022, the most recent reporting period. The company was able to maintain production at levels seen in 2021 during the first half of 2022 despite alumina costs almost doubling. Data from the London Stock Exchange Group's World Bureau of Metal Statistics indicates that Russian output may have dipped slightly in the first 11 months of 2022.

Overall, Rusal's aluminum production costs rose by 33.2% year over year to $2,028 per tonne in the first half of 2022, and gross profits from January through September 2022 fell by over 50% to 71.31 billion Russian rubles.

Rusal's revenues leaped 31% higher in the first half of 2022 compared to the same period of 2021, with 40% of sales coming from Europe and 7% from the U.S., compared to 37% and 9%, respectively. Rusal's net income will rise to $3.57 billion in 2022, up $342 million from 2021, according to Market Intelligence estimates.

Rusal did not respond to requests for comment.

Rusal has not been directly sanctioned and has maintained access to the London Metal Exchange, or LME. The exchange

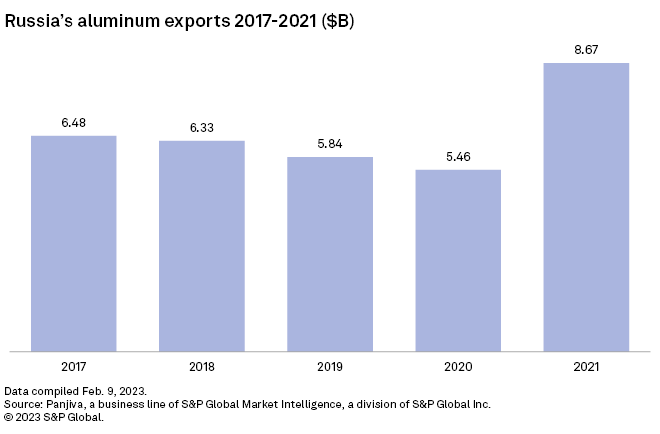

Despite the rise in costs, Rusal has found enough buyers to preserve profits. "Self-sanctioning," in which companies avoid purchasing from Russian manufacturers, seems to have had minimal impact on Russian aluminum exports in 2022 as Rusal shifted to exporting to China.

"Latest trade data indicates that Russian exports of the metal were little changed last year in volume terms. China was the main destination, taking almost one-quarter, with the total up almost 60% from 2021," a spokesperson for the London Stock Exchange Group, a financial information company and the owner of the London Stock Exchange, told Commodity Insights. "Sources say this was largely down to the profitability of importing, as a result of domestic demand and price differentials between the LME and [the Shanghai Futures Exchange]. Interestingly, imports by some western nations rose sharply last year."

Rusal's sales in the European and U.S. markets have been relatively stable, Huang Wenqian, vice president of Rusal's trading arm, Rusal Shanghai Economic and Trade Company Ltd., said in January at a Shanghai Metals Market conference.

Huang's comments sought to quell fears that the LME will be flooded with Russian metal in 2023 after several major aluminum consumers such as The Boeing Co., Norsk Hydro ASA and Novelis AG announced plans in September 2022 to end their contracts with the Russian producer.

"We maintain a solid sales book moving into 2023," Rusal said in a November 2022 statement. "Rusal has no intention to deliver metal to the exchange."

"There have been some movements of Russian metal into LME stocks in South Korea — for example, there was one last month — but it did nothing to impact the price," said Wood Mackenzie's Patel. "I think that's not front of mind for a lot of people on the LME in terms of price discovery."

Traders have told Wood Mackenzie that Russian stock is being held in places such as Malaysia and South Korea, according to Patel.

Looking to the future

Rusal said it is focusing on rebuilding its supply chain and entering new markets. The company is reportedly considering building an alumina plant to lower its reliance on Chinese imports, and it started production at a new smelter in Siberia in December 2022.

Rusal is aiming to sell more of its low-carbon aluminum to China, which will need supply for the production of electric vehicles. EV sales in China are expected to exceed 10 million units in 2025, according to a forecast by Market Intelligence.

"Currently, Rusal sells low-carbon aluminum in the Chinese market at premiums of $20-$40 per tonne," Huang said. "With the increasing demand for low-carbon products, [Chinese EV maker] NIO Inc.

There are doubts that China will be able to absorb all of Russia's extra aluminum in 2023 after China raised export tariffs on unwrought primary aluminum in January.

"This is much more of a medium-term Rusal strategy," Patel said. "At the moment, the reason why they're not really, from what we can see, putting a lot more metal into China is simply because China has sufficient metal at the moment relative to its consumption."

As of Feb. 22, US$1 was equivalent to 75.63 Russian rubles.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

Panjiva is the supply chain research unit of S&P Global Market Intelligence, a division of S&P Global Inc.

Evaluate the impact of the Russia-Ukraine conflict on the metals market with our essential mining intelligence. Learn more >